Marvelous Info About How To Avoid Paying Interest On Credit Cards

You can avoid getting charged interest altogether if you use these 5 techniques.

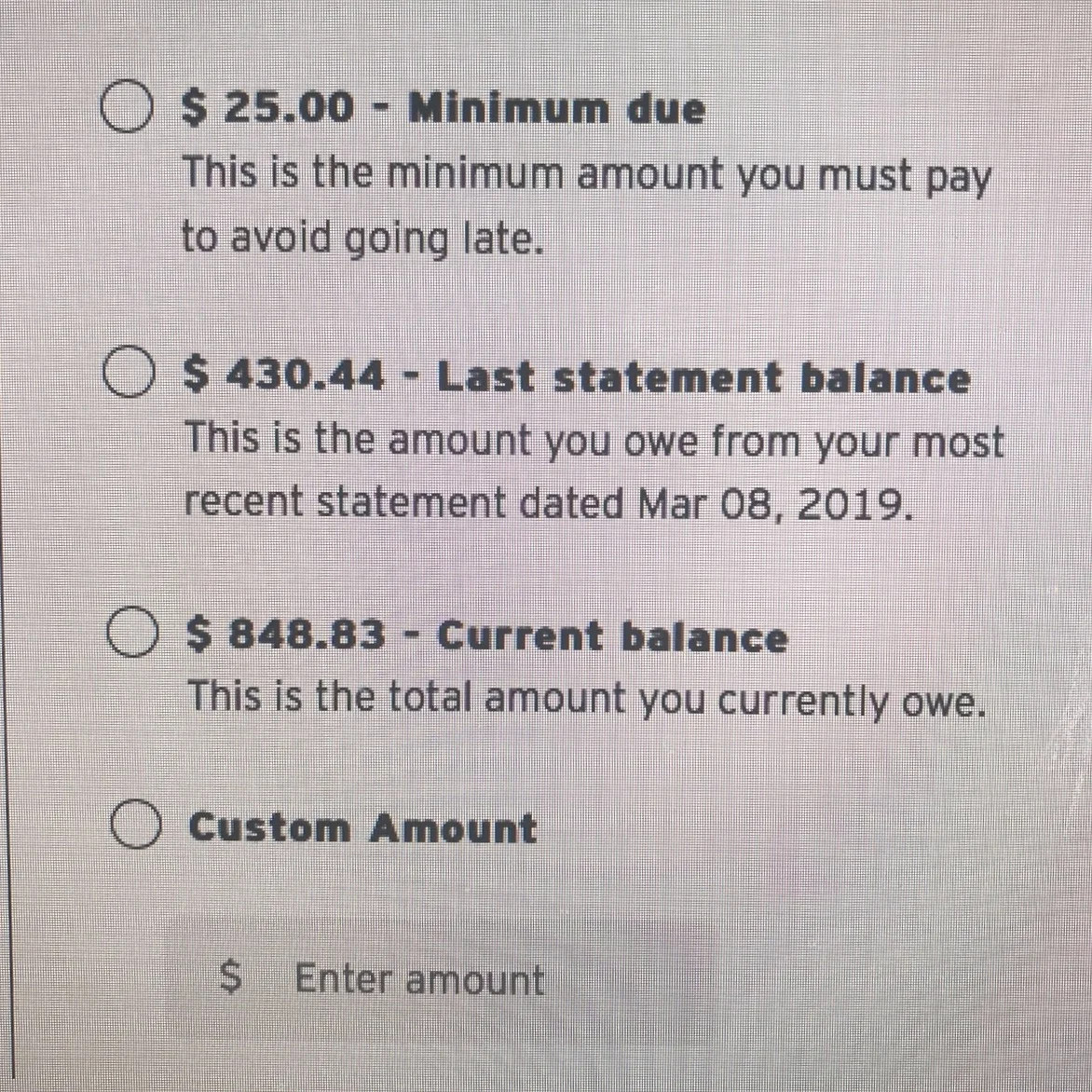

How to avoid paying interest on credit cards. This is the minimum amount you must pay before the due date, which could be a fixed amount or a percentage of the balance (whichever’s greater). If you get a new credit card with a 0% introductory balance transfer offer, you can usually avoid paying interest by paying off the debt you move over within the introductory. How to avoid interest on credit cards with an outstanding balance avoid new purchases.

That means either paying your credit card balance in full each month, or taking advantage of a 0%. Join 2 million residents already served. Debit card usage is limited to the cash you have on.

This means that the simplest way to avoid paying interest on your credit card bill is to never let it get late. 1.2 treat your credit card like a debit card; Pay your credit card bill in full every month.

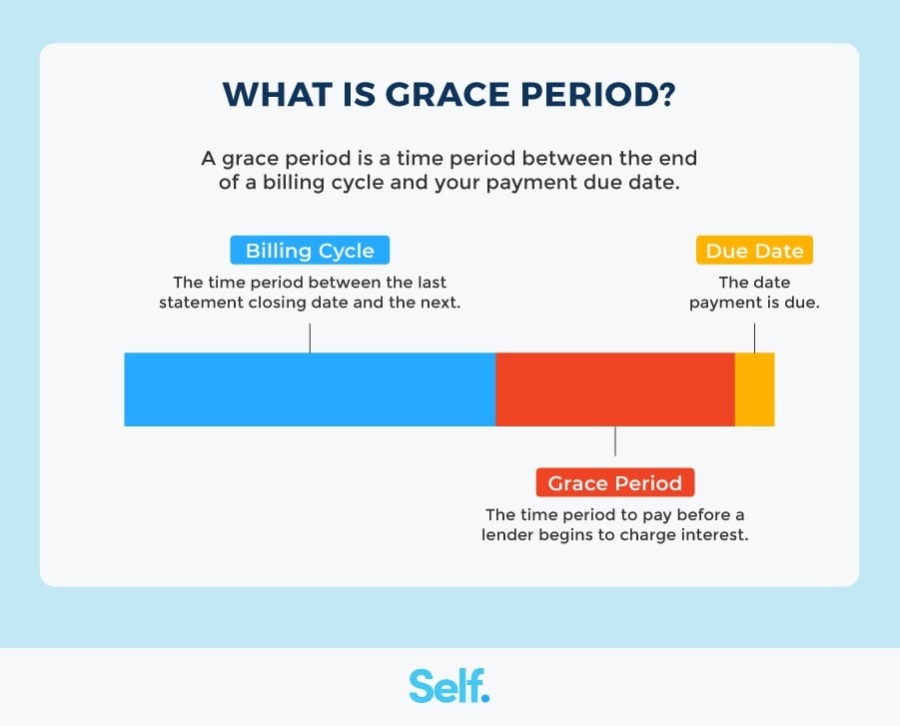

Now that we know how credit card interest works let’s talk about how to avoid paying it. Your credit card issuer will only charge you interest if you are late on your payment. This is the best way to avoid.

1.1 never carry a balance; If you’re unable to pay your credit card balance in full each month,. The bottom line is, just because you may be able to pay a loan with a credit card, it doesn’t mean you should.

Using credit cards to pay for every day expenses is better than using cash for a multitude of reasons. Fortunately, you don’t need to pay interest on your credit card if you use it wisely. With credit card you get points for every dollar you spend and you build.