Marvelous Tips About How To Become A S Corporation

Be domiciled in the united states

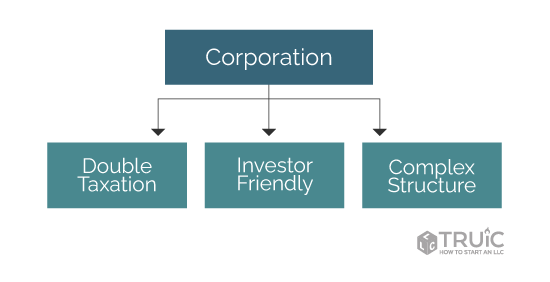

How to become a s corporation. In this video we go over how to start an s corp and how it is different from a typical business structure. These are important questions to ask yourself before forming an s corp. In order to qualify for s corporation status, the corporation must have no more than 75 shareholders.

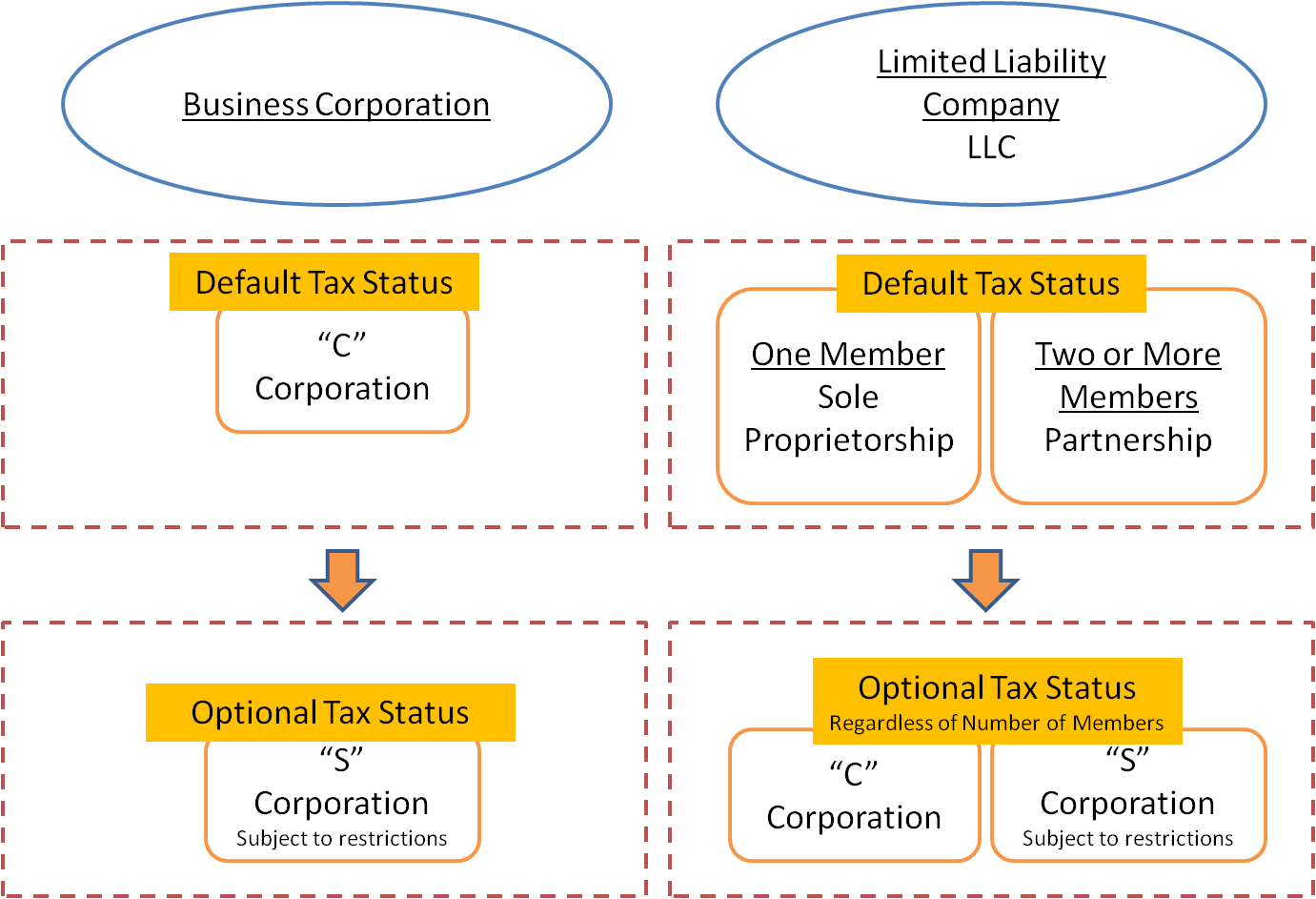

When an llc wants to be an s corporation instead, they will need to formally change their entity type with the formation state. S corps cannot have more than 100 shareholders, and only us citizens or permanent residents can be. Want to see if there’s another route that.

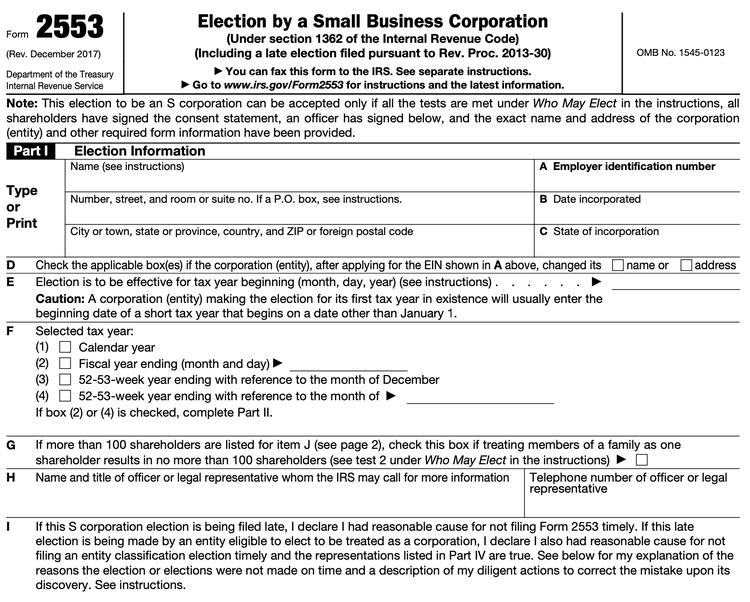

Election by a small business corporation with the irs. To prepare our students to become successful members of the global community. A corporation generally takes the same.

Comercios, restaurantes, instalaciones de ocio. It’s a popular tax election. The shareholders must agree in writing to the election to be an s corporation.

According to internal revenue service (irs), to qualify for s corporation status, the corporation must meet the following requirements: The s corporation is a tax designation that a corporation or llc can elect by filing form 553: S corporations are subject to the annual $800 minimum franchise tax;

At this time, they can also put in a request to change to an s. In forming a corporation, prospective shareholders exchange money, property, or both, for the corporation's capital stock. In order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders.

:max_bytes(150000):strip_icc():gifv()/corportation2-004d883ab23a45378324e0903f17d2d8.png)