Beautiful Work Info About How To Reduce Retained Earnings

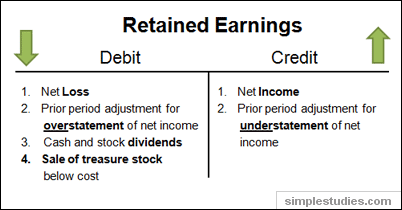

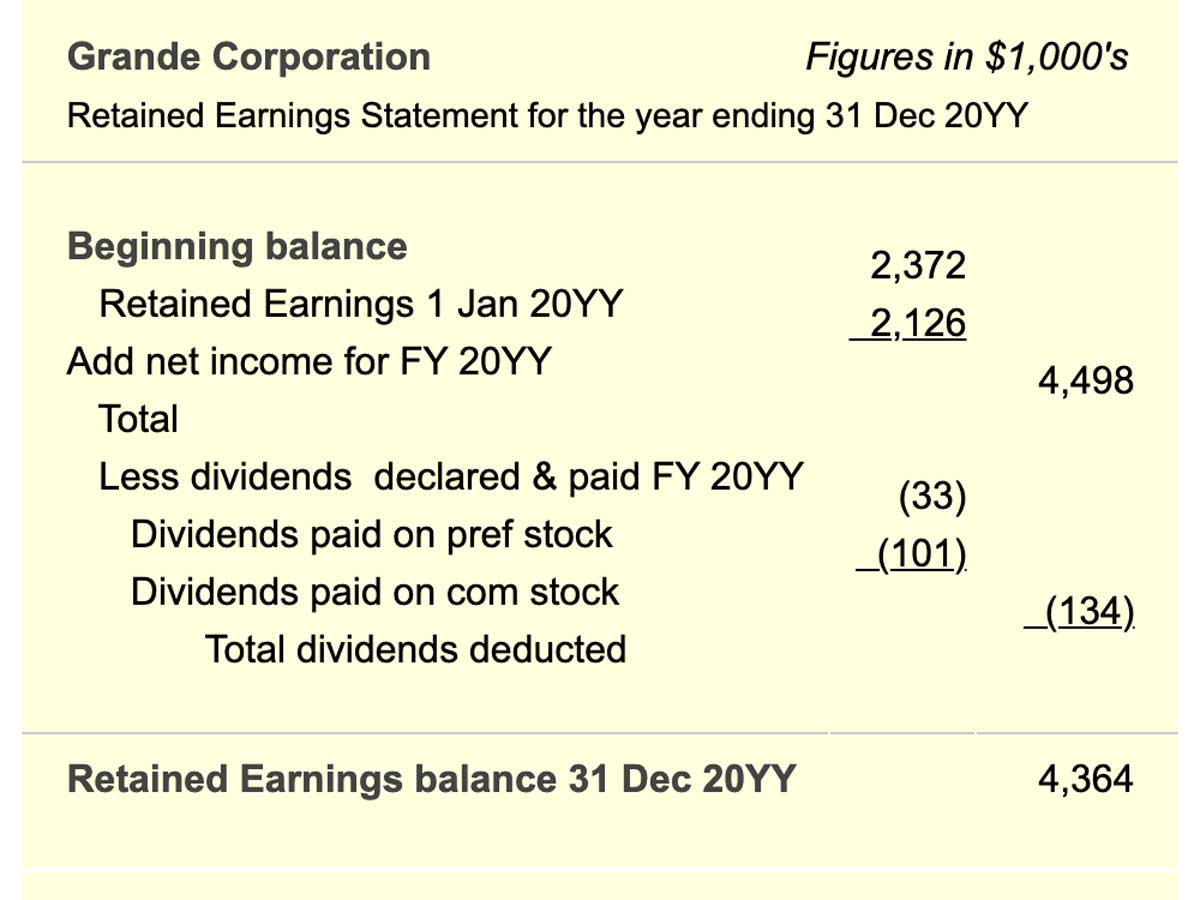

Debit your retained earnings account and credit your dividends expense.

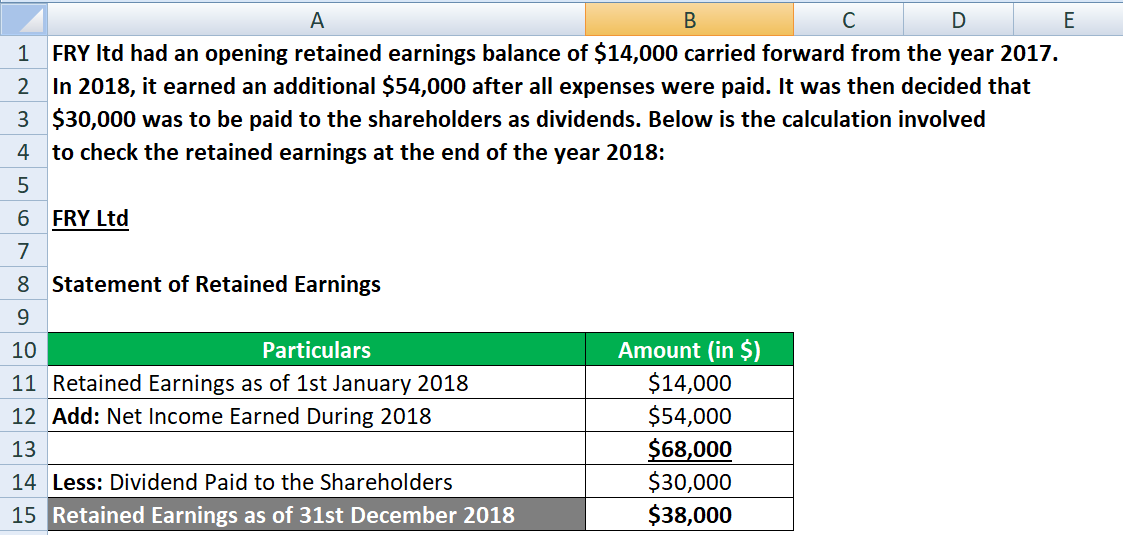

How to reduce retained earnings. Follow the simple formula for retained earnings, which is adding net income or subtracting net loss from your. Record a simple deduct or correction entry to show the adjustment. We have to record this revenue to increase the retained earnings as the prior year's income statement is already closed.

Use write checks, on the expense tab select retained earnings, and enter the amount, save. How do i reduce retained earnings in quickbooks? The dividend payment sometimes happens during the year when an entity wants to make payment to its shareholders.

Find the retained earnings account. This payment is declared by the entity when it gets approval from. The journal entry is debiting accounts receivable of $.

For example, if the difference between the total revenue and. Stock dividends reallocate a portion. Tick the run report from the action column.

Hi, how to fix the retained earnings issue in balance sheet. The same situation may arise if a company implements strong working capital policies to reduce its cash requirements. Choose preferences and then select the accounting option.

Click the gear icon on the top menu. Both forms of dividends reduce the retained earnings balance. Click the gear icon on the top menu.

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)